flow through entity tax break

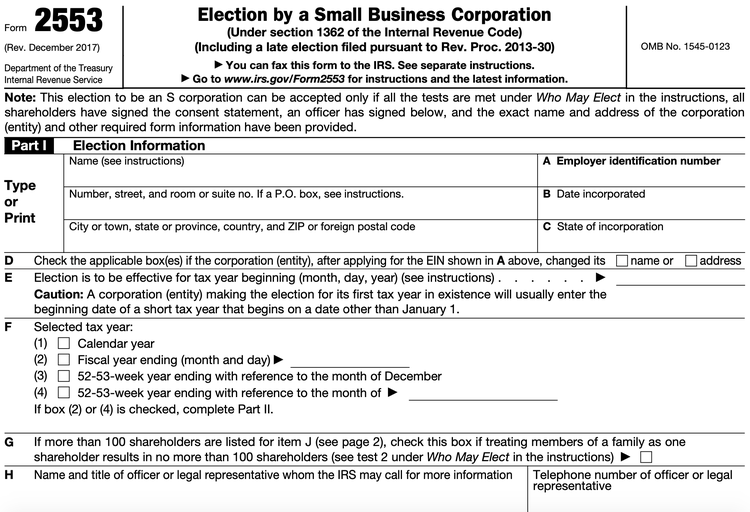

Utilizing partnerships and LLCs to solve S corporation structuring limitations. Flow-through entities are also known as pass-through entities or fiscally-transparent entities.

Net Operating Losses Deferred Tax Assets Tutorial

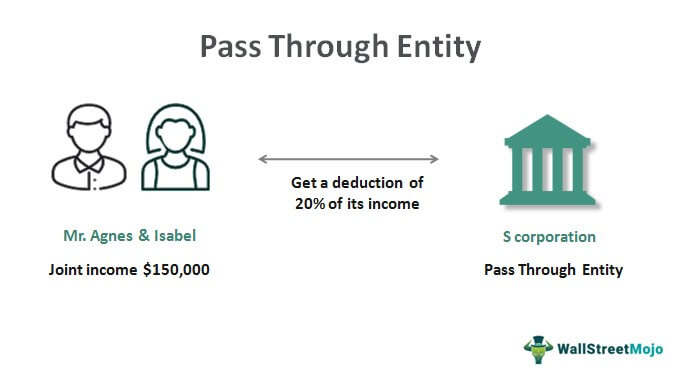

Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation.

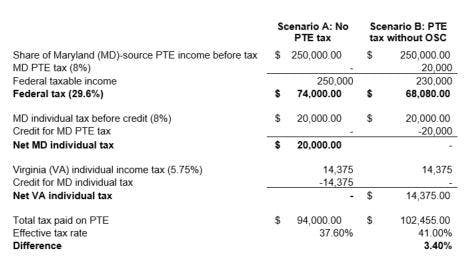

. The law signed by Whitmer on Dec. In the end the purpose of flow-through entities is the. This optional flow-through entity tax acts as a workaround to the state and local taxes SALT cap which was introduced in the Tax Cuts and Jobs Act of 2017 to limit the amount of SALT allowed as a federal itemized deduction to 10000.

You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. Using qualified S corporation subsidiaries and single-member LLCs. Same facts as the example above except that the business is an.

The flow-through entity tax is retroactive to tax years beginning on and after January 1 2021. You must determine whether the owners or beneficiaries of a flow-through entity are US. A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax.

A flow-through entity FTE is a legal entity where income flows through to investors or owners. That is the income of the entity is treated as the income of the investors or owners. Pritzker signed Public Act 102-0658 into law.

The continued levy of the tax is contingent upon the existence of the federal state and local tax SALT deduction limitation codified within IRC 164b6B. Flow-through Entity Tax Quarterly Estimated Tax Payments for Tax Years Beginning in 2021 Not Subject to Penalty or Interest. Instead all income of the business is passed through to the owners who report it on their personal income tax return and pay taxes at their effective marginal rate.

A trust maintained primarily for the benefit of employees of a corporation or 2 or more corporations that do not deal at arms length with each other where one of the main purposes of the trust is to hold interests. GreenStones tax and accounting department has spent time evaluating the possible benefits and. Or foreign persons how much of the payment relates to each owner or.

The majority of businesses are pass-through entities. 20 PA 135 of 2021 amends the state Income Tax Act to create a flow-through entity tax in Michigan. Around 212 million returns claimed the.

Instructions for Electing Into and Paying the Flow-Through Entity Tax. Flow-through entities are considered to be pass-through entities. On Friday August 27 2021 Illinois Governor JB.

You may also be required to treat the entity as a flow-through entity under the presumption rules. Because the business does not pay an entity-level tax pass-through entities avoid double taxation. Common Types of Pass-Through Entities.

Flow-Through Entity Tax Payments Due by March 15 2022 To Create a Member Income Tax Credit for Tax Year 2021. This legislation was passed as a workaround to the federal 10000 state and local tax deduction limitation that has frustrated many business owners since it was passed in 2017 as part of the Tax Cuts and Jobs Act. Eliminating C and S corporation penalty taxes by utilizing partnerships and other mechanisms.

According to Crains Chicago a rough estimate of tax savings to affected taxpayers is 80 million annually. Structuring the admission of the service provider. Generally you treat a payee as a flow-through entity if it provides you with a Form W-8IMY on which it claims such status.

Every profit-making business other than a C corporation is a flow-through. 5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan. Depending on the local tax regulations this structure can avoid dividend tax and double taxation because only.

Structuring the Flow-Through Entity. Flow-through entities are used for several reasons including tax advantages. Nearly 3 million more business owners claimed a 20 tax deduction on their income last year relative to the prior filing season according to IRS data.

The Act provides a significant tax break to owners of flow through entities S corporations and partnerships. Governor Whitmer signed HB. A flow-through entity is also called a pass-through entity.

Understanding What a Flow-Through Entity Is. The income of the business entity is the same as the income of the owners or investors. The income of the owners of flow-through entities are taxed using the ordinary.

According to information released by the state the flow-through entity tax allows certain flow-through entities to elect to file a return and pay tax on income in Michigan and allows members or owners of. This means that the flow-through entity is responsible for the taxes and does not itself pay them.

Net Operating Losses Deferred Tax Assets Tutorial

A Beginner S Guide To Pass Through Entities

Fy 2021 22 Or Ay 2022 23 New Income Tax Return E Filing Exemptions Deductions E Payment Refund Only 30 Second

Fifo Meaning Importance And Example

Formation Of Business Entities Law Chart The Letters C And S Represent Chapters In The Irs Tax Code C Law School Life Business Law Law School Prep

Qualified Business Income Finance Business Income

What Are The Benefits Advantages Of Using Cash Flow Statement

What Is Input Tax Credit Or Itc Under Gst Exceldatapro Cash Flow Statement Accounting Tax Deductions

Flow Through Entity Overview Types Advantages

Pass Through Entity Tax 101 Baker Tilly

Canadian Corporations Canadian Business Law Kalfa Law

Understand The Differences Between Sole Proprietorships Llcs And Corporations Including Ownership St Business Format Business Ownership Business Infographic

Pass Through Entity Definition Examples Advantages Disadvantages

Net Operating Losses Deferred Tax Assets Tutorial

Employee Stock Ownership Plans

Pass Through Entity Definition Examples Advantages Disadvantages